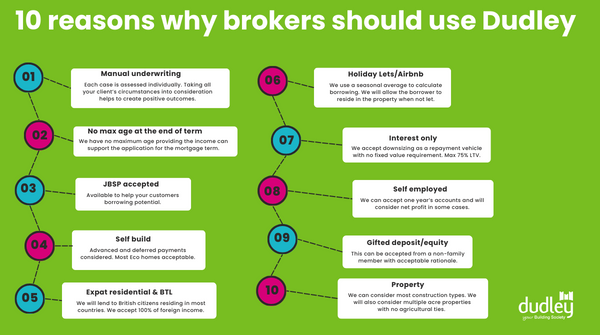

10 reasons why brokers should use Dudley

At Dudley we do mortgages differently. We treat all cases individually and underwrite all our cases manually. This means we can often support complex lending and place cases that other lenders cannot.

There are lots of great reasons to use Dudley Building Society to place your complex and specialist mortgage lending – here are just 10 of them.

1. Manual underwriting

Each case is assessed individually. Taking all your client’s circumstances into consideration helps to create positive outcomes.

2. No max age at the end of term

We have no maximum age providing the income can support the application for the mortgage term.

3. JBSP accepted

Available to help your customers borrowing potential.

4. Self build

Advanced and deferred payments considered. Most Eco homes acceptable.

5. Expat residential & BTL

We will lend to British citizens residing in most countries. We accept 100% of foreign income.

6. Holiday Lets/Airbnb

We use a seasonal average to calculate borrowing. We will allow the borrower to reside in the property when not let.

7. Interest only

We accept downsizing as a repayment vehicle with no fixed value requirement. Max 75% LTV.

8. Self employed

We can accept 1yrs accounts and will consider net profit in some cases.

9. Gifted deposit/equity

This can be accepted from a non-family member with acceptable rationale.

10. Property

We can consider most construction types. We will also consider multiple acre properties with no agricultural ties.

Find out more about our products

Our website is packed full of useful blogs, guides and information about our products. We also include case studies to highlight how we were able to help brokers place cases. Here are some examples:

Mortgages without borders – Dudley delivers more expat mortgages

This blog looks at why we have been getting more enquiries and why we have been placing more mortgages. It also includes case studies about expat mortgages BTL, expat mortgages holiday let and expat mortgages residential.

The growing popularity of Join Borrower Sole Proprietor (JBSP) mortgages

This blog looks at the broader economic reasons why there has been an increase in JBSP mortgages. We also include a relevant case study that shows how we supported a broker to help their client arrange the mortgage they required.

In addition to specific product information and case studies, we also talk about issues and business strategies that can help broker’s develop their business.

10 reasons to prioritise mortgage customer retention

In this blog we look at the importance of prioritising mortgage customer retention and rank the most important reasons why this is important to brokers.

About us

We are a broker-friendly lender and would love to hear from you. Follow the links below to find out more about our product and services. Our friendly support team is only a phone call or email away.

Find out more about our Expat Mortgages

Find out more about our Holiday Lets Mortgages

Find out more about our Intermediary mortgage product range.

Check out our latest mortgage rates and product guides

Back to top

Back to top