The growing popularity of Joint Borrower Sole Proprietor (JBSP) mortgages

The growing popularity of Joint Borrower Sole Proprietor (JBSP) mortgages

At Dudley Building Society we are always looking for innovative and flexible ways to help people achieve their property dreams. Working closely with our fantastic broker network we are constantly exploring new ways to help meet the needs of the market.

Increased enquiries for Joint Borrower Sole Proprietor (JBSP) mortgages

We have seen a big increase in the number of enquiries for JBSP mortgages over the last few months. We have also seen a rising number of enquiries where applicants are asking about Maximum Age at End of Term. In our case study below both requirements were needed. And we’re not alone. The sourcing system Knowledge Bank recently reported that JBSP and Maximum Age at End of Term were two of their most searched term.

But why are we seeing such high demand for these types of mortgages?

The growth of Joint Borrower Sole Proprietor (JBSP)mortgages

The ‘Bank of Mum and Dad’ (BoMaD) is an established way for parents to help their children get on the property ladder. This is Money stated last year that BoMaD contributed to almost 50% of house purchases.

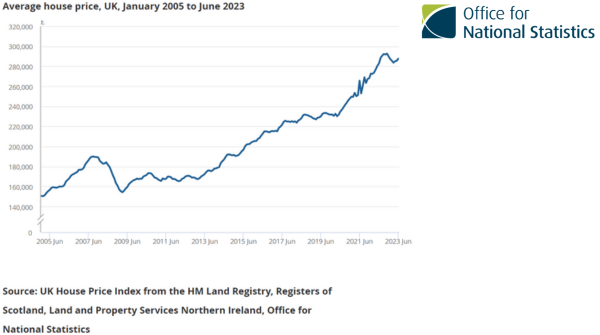

The growth in the cost of housing in the UK shows one of the reasons why this is the case. According to UK Government figures the average UK house price has increased almost 67% over the last 10 years (June 2013 average price £172,655 vs June 2023 average price £287,546).

Other factors like the cost-of-living crisis seen in the UK during 2022 and 2023 have further put pressure on finances. This means borrowers are having to adapt to changing and evolving markets.

How Dudley can help

The BoMaD is one thing, but our Joint Borrower Sole Proprietor mortgages can accept up to FOUR borrowers.

“The increase of JBSP mortgage enquiries reflects how the mortgage market is constantly evolving and changing to meet the challenges of changing economic conditions. At Dudley we can react to these changing market dynamics because we are flexible, agile, and proactive. With our team of underwriters and close relationships with brokers we can meet the needs of borrowers. Having four applicants on our applications is just one of the ways we are meeting the increase in demand for these types of mortgages.” Robert Oliver, Distribution Director

Maximum Age at End of Term

Our case study below illustrates why brokers are asking about the Maximum Age at End of Term for some applicants. In this case, the parent of the borrower on a JBSP mortgage wanted to contribute until they retired at age 75. This is connected to a wider trend of first-time borrowers getting older. This 2023 article in The Telegraph states that ‘the average first-time buyer today will be paying off their loan until the age of 64’. As housing costs increase the time taken to save for a deposit increases.

Joint Borrower Sole Proprietor and Maximum Age at End of Term case study

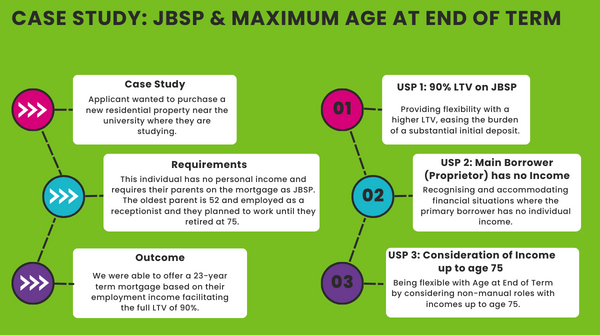

This is a compelling case study that vividly illustrates how our flexible mortgage solutions cater to unique scenarios.

This case involves an applicant who wanted to purchase a new residential property near the university where they are currently studying to become a doctor. This individual has no personal income and requires their parents on the mortgage as JBSP. The oldest parent is 52 and employed as a receptionist and they planned to work until they retired at 75.

We were able to offer a 23-year term mortgage based on their employment income facilitating the full LTV of 90%.

Our USPs

1. 90% LTV on JBSP: Providing flexibility with a higher LTV, easing the burden of a substantial initial deposit.

2. Main Borrower (Proprietor) has no Income: Recognising and accommodating financial situations where the primary borrower has no individual income.

3. Consideration of Income up to age 75 for non-manual roles: Being flexible with Age at End of Term by considering non-manual roles with incomes up to age 75.

About us

We are a broker friendly lender and we would love to hear from you. Follow the links to find out more:

Learn about our complex income mortgage solutions.

Find out more about our Intermediary mortgage product range.

Check out our latest mortgage rates and product guides

Back to top

Back to top